Why ClearAccept?

Built for your ClearCourse software

Our ongoing collaboration with your software provider means that ClearAccept will develop, adapt and grow with your business – and the world you’re operating in.

Why ClearAccept?

Payments: however you need to accept them

Whether your customer is online, on the phone or standing right in front of you, our payments platform enables you to take their payment quickly, easily and securely.

And this, in turn, helps you increase sales, reduce admin and save time and money that you can invest elsewhere in your business.

Why ClearAccept?

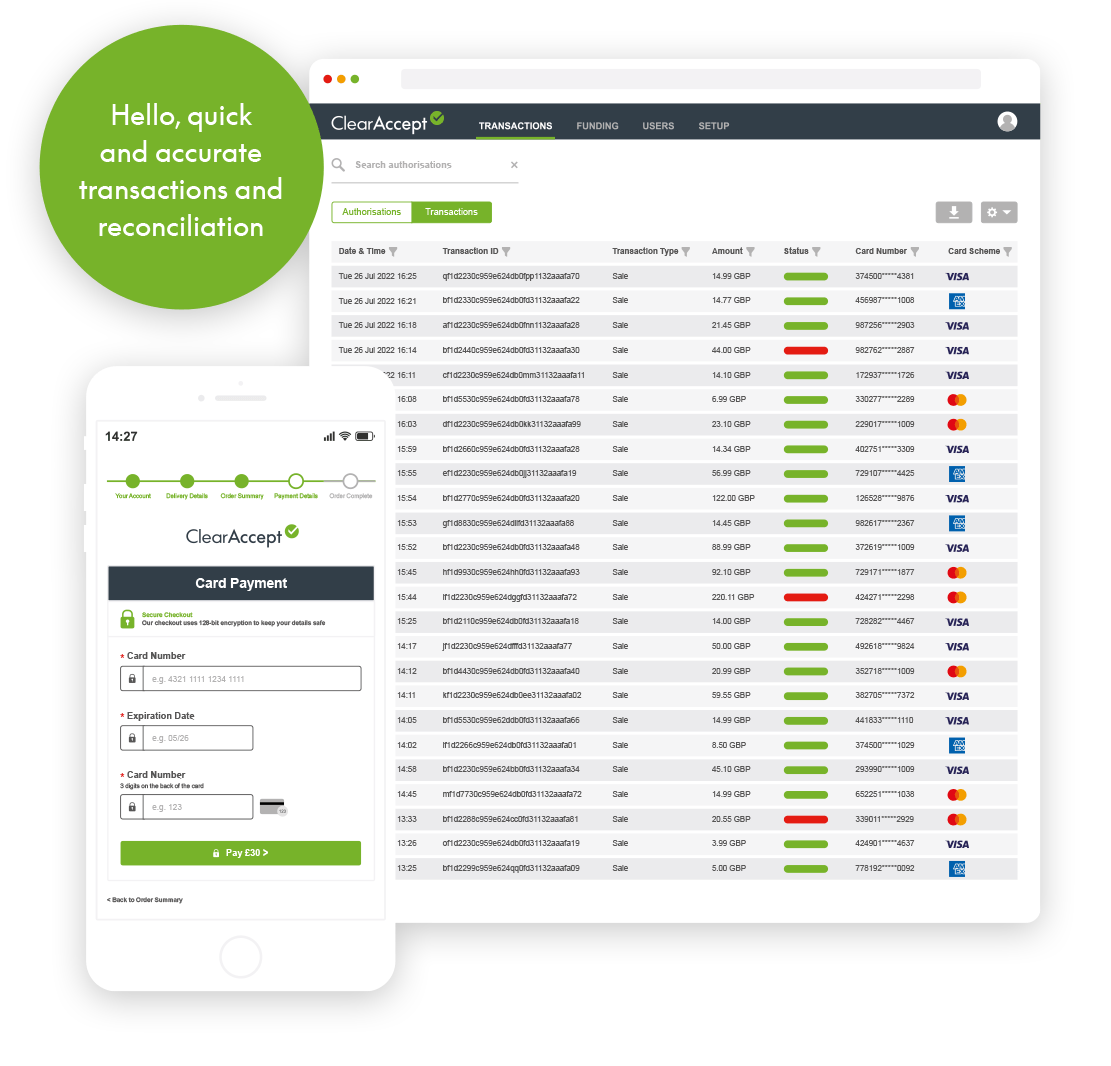

Seamless integrations to support your business’s growth

We’re built into the software you already trust, which means you can manage all of your payments in the same place you manage your business.

And, by bringing all of your payment methods into one place the reporting process is simple, too.

Why ClearAccept?

Our clients have so many great things to say about us

“A volume of payments that would have taken us 15 hours to process using our previous CRM and payments suppliers now, through Silverbear 365 and ClearAccept, it takes less than two hours.”

Simon Berney-Edwards, CEO of Expert Witness Institute

“Moving to integrated payments has not only improved our customer service with a considerably quicker card payment but also reduced the risk of manual errors.”

Nicola Bell, Head of Retail Warrington Wolves

“The system is extremely easy to use and the daily reports straight forward and easy to download. This system has made life easier at the club.”

Royal Winchester Golf Club